Today’s Wealth Daily is a special one. Its author is Bill Lowe. You probably have never heard of him because he retired from public life years ago to focus on the things he really enjoys: 1) outdoor activities, like hunting and hiking in his home state of Montana; and 2) managing his personal portfolio. But Bill is one of the co-founders of Angel Publishing. As a business owner and professional investor, he has some insight into the current market crisis.

Take it away, Billy boy…

“In reading the history of nations, we find that, like individuals, they have their whims and their

peculiarities; their seasons of excitement and recklessness, when they care not what they do.

“We find that whole communities suddenly fix their minds upon one object, and go mad in its

pursuit; that millions of people become simultaneously impressed with one delusion, and run

after it, till their attention is caught by some new folly more captivating than the first.”

— Charles Mackay

I got a desperate call from a friend on March 18. His portfolio was a wreck.

“Well, we’ve got a situation here,” he panted. “I think you can appreciate that. I’ll tell you… this thing really knocked my wind out. It’s got me up nights, that’s the truth.”

His fear was palpable. When I told him to buy, he groaned.

On March 23, five days later, the market bottomed.

I forgive him for being a beta, a follower. After all, if everyone was contrarian, then no one would be. Where would that leave us?

When there’s a bull market in hysteria, the pros absolutely feast on the dislocations, the gaps in value that are left behind. Predictably, the masses ginned up end-of-world scenarios… with each prediction of death and economic ruin worse than the last. It was difficult to see through the haze of hysteria in the headlines.

Here at Wealth Daily, we’ve been having a conversation about what to do when the market turns. In fact, Brian and I have been in an on-going conversation about it since late December. We were already sitting on a lot of cash because we thought the market was ripe for a dramatic pullback at best… a correction at worse. We just didn’t think it would come in the form of a pandemic that would bring the global economy to its knees.

There was a short list of quality companies to buy when the inevitable correction came. When that event was triggered, regardless of the events that caused it, we were calm and measured. In short, we were prepared. And so were you.

After a 10-year bull run, the question was, “How much better can it get?” So it was prudent to de-risk and expect a reversal at some point.

Now that it’s here, what to make of it? The market is telling us that this is a one-time event and that the virus is not the murder machine we were told it was. That’s not to say there aren’t serious questions that need to be answered.

There are.

Could the monetary and fiscal cure end up being worse than the disease?

Will we retest the March lows?

Is it time to take profits off the table?

Should I be stockpiling food and guns?

The Empty Quarter

The Rub’ al Khali, also known as the “Empty Quarter,” is a vast desert, a wasteland encompassing the southern third of the Arabian Peninsula. A sea of sand larger than France, it’s definitely not conducive to growth.

The past three months have, in economic terms, been an empty quarter. An economic Rub’ al Khali.

You’ve already seen the stats. The sand is everywhere:

- 38.6 million people have filed unemployment claims.

- The airline industry has contracted by 95%.

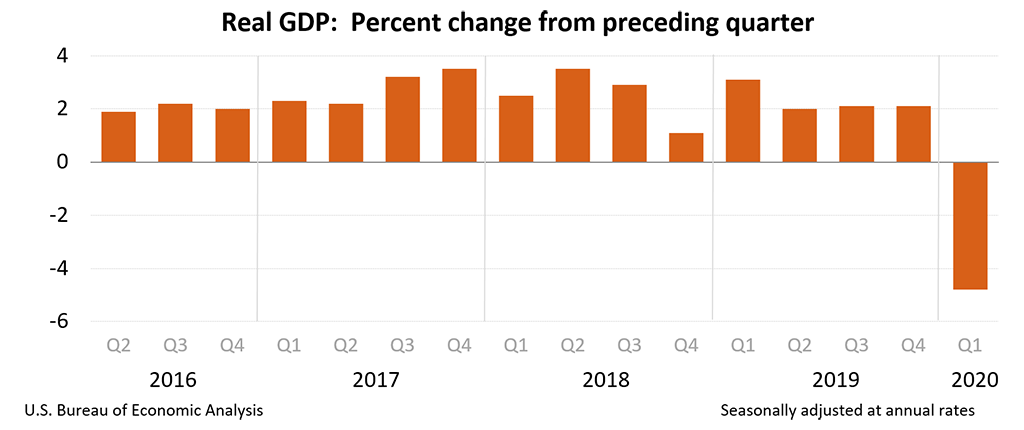

- GDP dropped 4.8%.

- Retail sales are down 22%.

Choose your sector. In most cases, revenue has been vaporized.

According to the Trump administration, the federal stimulus has totaled $6 trillion so far, 25% of U.S. GDP, with more on the way. In fact, right now, Democrats are working on another $3 trillion spending package.

Fed head Jerome Powell is on record saying his cabal, the Fed, is committed to doing everything it can for as long as it needs. Again, everything it can, for as long as it needs. As a result, from the pit of despair in March, stocks rallied anywhere from 30% to 50%. As of this writing, the NASDAQ has rebounded so hard and fast, it now sits within 4% of its all-time highs. It’s almost unbelievable. Almost.

But this market crash and rebound wasn’t based on fundamentals. It was based on emotion and human nature. And that’s what professional investors understand more than anything. The fear center of your brain conspired against you, telling you the end was here.

But you knew better.

You read our missive on March 13 and were calmed by the soothing words of Brian Hicks:

So let me calm you down and show you how this is another generational buying opportunity.

We rode the resulting tidal wave of liquidity to some of the easiest market gains you’ll ever witness. This was all, as Christian DeHaemer pointed out in an essay for Energy and Capital, thanks to Jerome Powell.

Which brings us back to the question, “Is the “solution” of fiscal and monetary response worse than the problem it’s designed to solve?”

This is the question that has perhaps the most serious potential for trouble down the road.

These are the forces that will drive the macro trends for years to come. The delayed and indirect consequences of this level of money creation will ripple out from the stock market like waves on a pond. The winners will hold real assets of all stripes. Assets of every kind will rise in price. Dollars, as they have been, will be a wasting asset.

Unfortunately, for the tinfoil hat crowd, this doesn’t spell the end of the dollar. We’re not going to see Venezuelan-style inflation. What we’ll see is asset price inflation and a rising stock market. Powell’s wave of liquidity will wash over markets and economies across the globe.

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Surviving the Coming Economic Collapse

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

A Dose Of Reality

Much more concerning than the virus itself or the monetary inflation is the erosion of liberties that will certainly come in its wake.

Tragically, we’re now under threat not just from the government but from the private sector as well. The battle of free minds versus censorship is heating up.

If you were caught flat-footed back in March, I urge you to think back and remember how you felt. Were you wishing you had more supplies on hand? If so, start to accumulate them.

Were you wishing you had less exposure to equities? Maybe it’s time to reduce exposure, to raise cash.

Were there skills you were lacking? Gain them now.

What should be clear is that you’ve got to act in advance of the crowds. When the masses are clamoring to one side of the ship, you want to be on the other. That’s what we do here — help you understand the forces driving markets and make informed decisions.

The Bright Side

Within our empty quarter, we’ve discovered some incredible bargains on companies that are sure to ride out the storm. In fact, the gains came so fast and so easily, it was like a gift from the market gods.

In fact, if June behaves like April and May, this second quarter will be the greatest quarter of my entire investing career.

But if your eyes were clouded over with the mist of hysteria, you were left behind.

During the depths of the downturn, our analysts offered calm, reasoned strategies for how to navigate and what to buy. The resulting rally was one for the books. Even our most bearish editors found ways to win.

And remember, like Hillary says, never let a good crisis go to waste. Don’t succumb to your fears. STOP: stop, think, observe, plan.

I’m going to ask you to consider a single data point: The average age of Americans who died from COVID-19 between February 1 and May 2 was 75 according to an analysis of a provisional data set published by the Centers for Disease Control’s National Center for Health Statistics (NCHS) on Wednesday.

U.S. life expectancy is 78.6.

If you fall within that cohort, you know exactly what you need to do. If not, statistically, it doesn’t matter much what you do.

The economic damage is real. I’m sure everyone reading this can rattle off a handful of businesses that have gone under in the past month. It’s largely a self-inflicted wound, and it’s pervasive.

If we do have a resurgence of the virus and another economic Rub’ al Khali, chances are good we will retest March lows. If so, you’ll know what to do. Either way, the Fed will continue its aggressive monetary response, and chances are a year from now we’ll be in a different world. You don’t have to like the Fed’s actions or agree with it. You’ve simply got to play the cards you’re dealt.

Best regards,

Bill Lowe